As of January 2025, inflation remains above the Federal Reserve’s 2% target, with the Personal Consumption Expenditures (PCE) Price Index rising 2.5% year-over-year. This persistent inflation presents both challenges and opportunities for multifamily real estate investors.

Inflation’s Impact on Multifamily Real Estate

Elevated inflation can erode purchasing power and increase operational costs. However, multifamily properties often serve as a hedge against inflation due to their ability to adjust rents in response to market conditions. Short-term leases allow property owners to realign rental rates with current inflation levels, maintaining cash flow and asset value.

Strategic Considerations for Investors

-

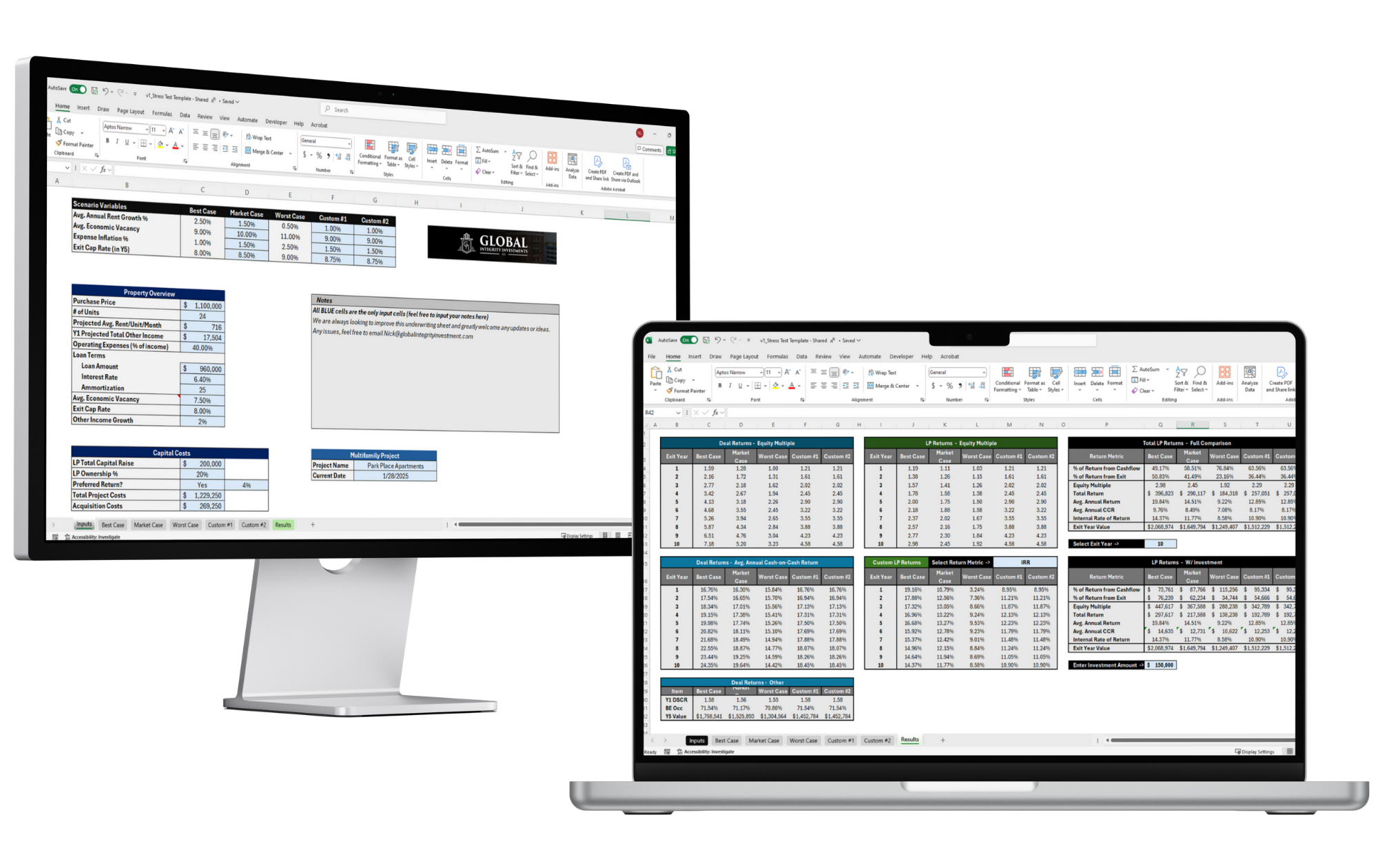

Stress Testing Investments: In uncertain economic climates, it’s prudent to conduct stress tests on potential acquisitions. This involves modeling various economic scenarios to assess a property’s financial resilience. By evaluating factors such as occupancy rates, rent growth, and expense fluctuations, investors can identify vulnerabilities and make informed decisions. Utilizing a comprehensive stress test spreadsheet can aid in this analysis.

-

Monitoring Economic Indicators: Staying informed about economic trends is crucial. For instance, recent data indicates that while consumer spending decreased by 0.2% in January, inflationary pressures persist, suggesting that the Federal Reserve may maintain current interest rates throughout much of 2025. Understanding these dynamics helps investors anticipate financing costs and adjust strategies accordingly.

-

Operational Efficiency: Inflation often leads to rising expenses. Implementing cost-control measures, such as renegotiating vendor contracts and leveraging bulk purchasing, can mitigate the impact on net operating income. Additionally, exploring alternative revenue streams, like implementing a ratio utility billing system (RUBS), can enhance profitability.

Conclusion

While elevated inflation poses challenges, it also underscores the resilience of multifamily real estate investments. By conducting thorough stress tests, staying attuned to economic indicators, and enhancing operational efficiencies, investors can navigate this environment effectively and capitalize on emerging opportunities.

For a deeper understanding of the current inflation landscape, refer to the Morningstar article. To assess your investments’ resilience, download our Stress Test Spreadsheet.