Transforming Spaces for a Sustainable Future

In recent years, the real estate landscape has witnessed a significant shift, with a growing trend of converting underutilized office spaces into residential multifamily units. This movement, known as adaptive reuse, offers a promising solution to urban housing shortages and the challenges posed by vacant commercial properties. At Global Integrity Investments, we specialize in acquiring and revitalizing distressed multifamily projects, turning them into valuable assets that benefit both investors and communities.

The Rise of Office-to-Residential Conversions

Several factors have contributed to the surge in office-to-residential conversions. The COVID-19 pandemic accelerated remote work trends, leading to increased office vacancies in urban centers. As businesses reevaluate their space needs, many office buildings have become obsolete, presenting opportunities for redevelopment. According to a report by RentCafe, a total of 55,339 multifamily units are in the conversion pipeline nationally, with Washington, D.C., and New York City leading the way with 5,820 and 5,215 units underway, respectively.

Benefits of Adaptive Reuse

Adaptive reuse offers numerous advantages:

- Economic Benefits: Converting existing structures can be more cost-effective than new construction, as it often involves lower material and labor costs. This approach also allows developers to capitalize on prime locations without the expense of land acquisition.

- Environmental Sustainability: Repurposing buildings reduces demolition waste and minimizes the environmental impact associated with new construction. It also preserves the embodied energy of existing structures, contributing to sustainability goals.

- Community Revitalization: Transforming vacant offices into residential units breathes new life into urban areas, enhancing neighborhood vibrancy and supporting local businesses.

Challenges in Office-to-Residential Conversions

Despite the benefits, these projects come with challenges:

- Structural and Architectural Hurdles: Office buildings are designed differently from residential spaces, often requiring significant modifications to meet housing standards, such as adding windows or reconfiguring floor plans.

- Regulatory and Zoning Challenges: Navigating local zoning laws and building codes can be complex, potentially leading to delays and increased costs.

- Financial and Market Risks: Market demand must be carefully assessed to ensure the viability of conversion projects, and unexpected expenses can arise during construction.

Economic Considerations for Adaptive Reuse Projects

When evaluating adaptive reuse projects, it’s essential to conduct a thorough cost-benefit analysis. While conversions can offer savings compared to new builds, factors such as structural modifications, compliance with current building codes, and the installation of modern amenities can impact overall costs. However, with proper planning and execution, these projects can yield attractive returns on investment. Government incentives, such as tax credits and grants, can further enhance financial feasibility. For instance, the proposed Revitalizing Downtowns and Main Streets Act aims to offer tax credits for conversions and expand existing federal lending programs to include commercial conversions.

Case Studies of Successful Conversions

Several notable projects exemplify successful office-to-residential conversions:

- 25 Water Street, New York City: Formerly an office tower, this building has been transformed into SoMA (South Manhattan), a luxury apartment complex featuring 1,320 residential units and a host of amenities. This project stands as the largest office-to-residential conversion in U.S. history.

- Santander Tower, Dallas: In Texas, developers are converting vacant office spaces into downtown housing units, addressing both the surplus of unused workspace and the demand for urban living options.

These projects highlight the potential for adaptive reuse to create desirable residential spaces in prime urban locations.

The Role of Government Policies

Government initiatives play a crucial role in facilitating office-to-residential conversions. The Revitalizing Downtowns and Main Streets legislation, if passed, would offer tax credits for conversions and expand existing Housing & Urban Development federal lending programs to include commercial conversions. Such policies can make adaptive reuse projects more financially viable and encourage investment in urban revitalization.

Market Demand and Demographics

Urban centers continue to experience strong demand for housing, driven by population growth and a preference for city living among younger demographics. Converting office spaces into residential units can help meet this demand, providing modern housing options in desirable locations. Understanding the target market is essential for tailoring design and amenities to attract prospective residents.

Design and Architectural Considerations

Successful conversions require thoughtful design to adapt office layouts for residential use. This may involve reconfiguring floor plans to create functional living spaces, ensuring adequate natural light, and incorporating modern amenities. Sustainable design practices, such as energy-efficient systems and the use of eco-friendly materials, can enhance the appeal of the finished units.

Financial Strategies for Investors

Investors interested in adaptive reuse projects should explore various funding options, including traditional financing, private equity, and government incentives. Conducting thorough due diligence, assessing market conditions, and developing a comprehensive business plan are critical steps in mitigating risks and ensuring project success.

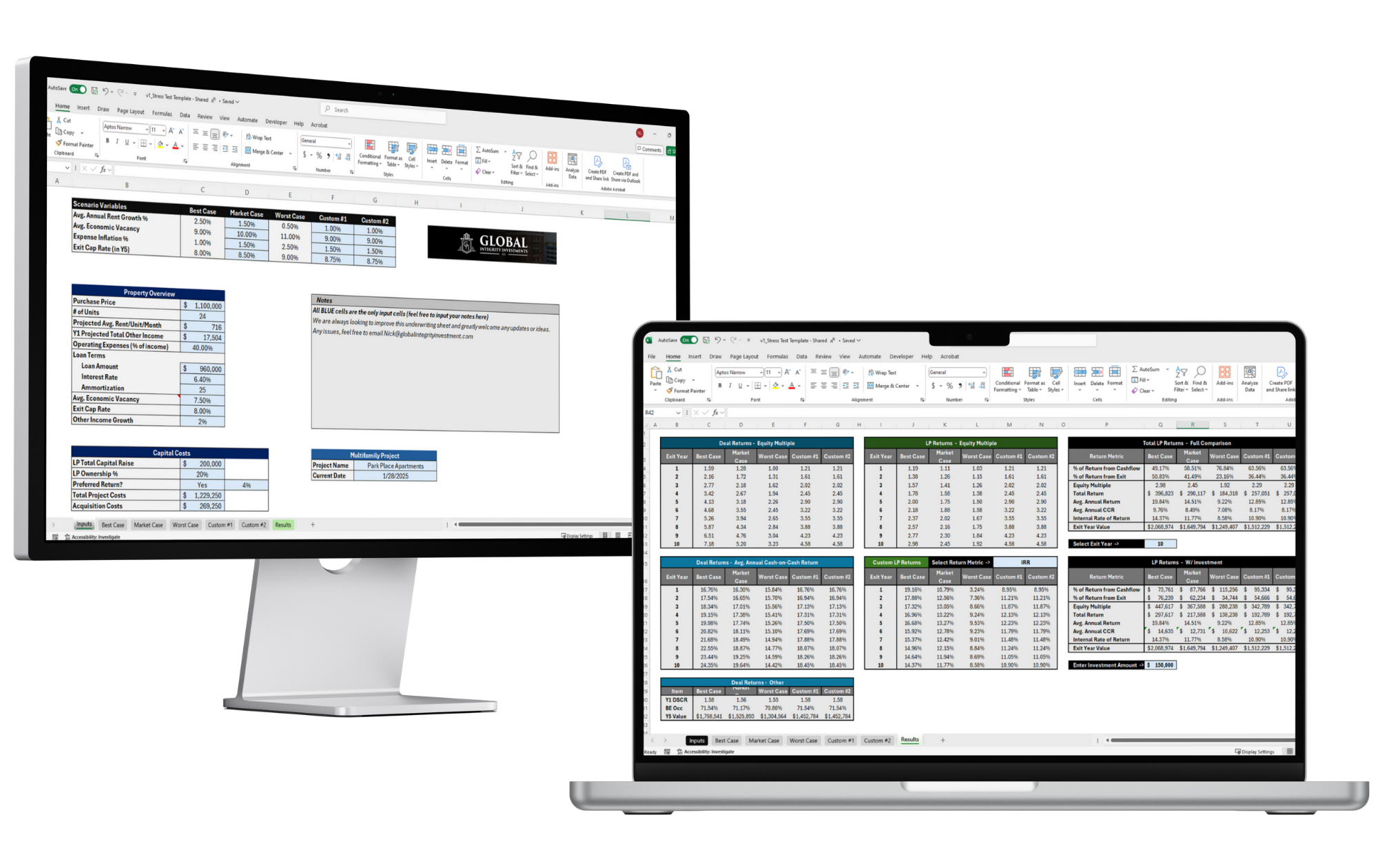

Global Integrity Investments’ Approach

At Global Integrity Investments, we specialize in acquiring value-add multifamily projects that require substantial rehabilitation. Our expertise in transforming distressed properties allows us to create high-quality residential units that meet market demand and contribute to community revitalization. We are committed to sustainable development practices and delivering value to our investors.