When it comes to passive multifamily real estate investments, most investors focus on cash flow, IRR, or equity multiples. While these are important, they don’t tell the full story of risk-adjusted returns—and that’s where the Sharpe ratio comes in.

What is the Sharpe Ratio?

The Sharpe ratio measures how much return an investment generates above the risk-free rate per unit of risk taken. In simpler terms, it tells you whether your returns are worth the volatility and uncertainty you’re accepting.

The formula is:

Sharpe Ratio= ((Portfolio Return)−(Risk-Free Rate)) / (Portfolio Standard Deviation)

For passive investors, a higher Sharpe ratio means you’re getting better returns relative to the risk involved.

Why Multifamily Investors Should Care

Many passive investors compare deals based on IRR alone, but this can be misleading if you don’t account for risk volatility. A deal promising a 20% IRR might sound appealing, but if it comes with extreme market swings, high leverage, or an unpredictable sponsor, the risk may outweigh the reward.

Here’s why the Sharpe ratio should be in your investment toolkit:

- True Risk-Adjusted Returns – It factors in volatility, helping investors avoid “high return, high risk” traps.

- Compare Deals More Accurately – A deal with a 15% IRR and a high Sharpe ratio may be superior to a 20% IRR deal with excessive risk.

- Optimize Portfolio Diversification – Investors can use it to balance risk across multiple multifamily deals, ensuring their portfolio aligns with their risk tolerance.

What’s a Good Sharpe Ratio in Multifamily?

While Wall Street aims for 1.0+, real estate tends to have slightly higher ratios due to stable cash flows. In multifamily:

- Below 1.0 – Risk may be too high for the return generated.

- 1.0 – 1.5 – A solid risk-adjusted return.

- Above 1.5 – Strong performance with good downside protection.

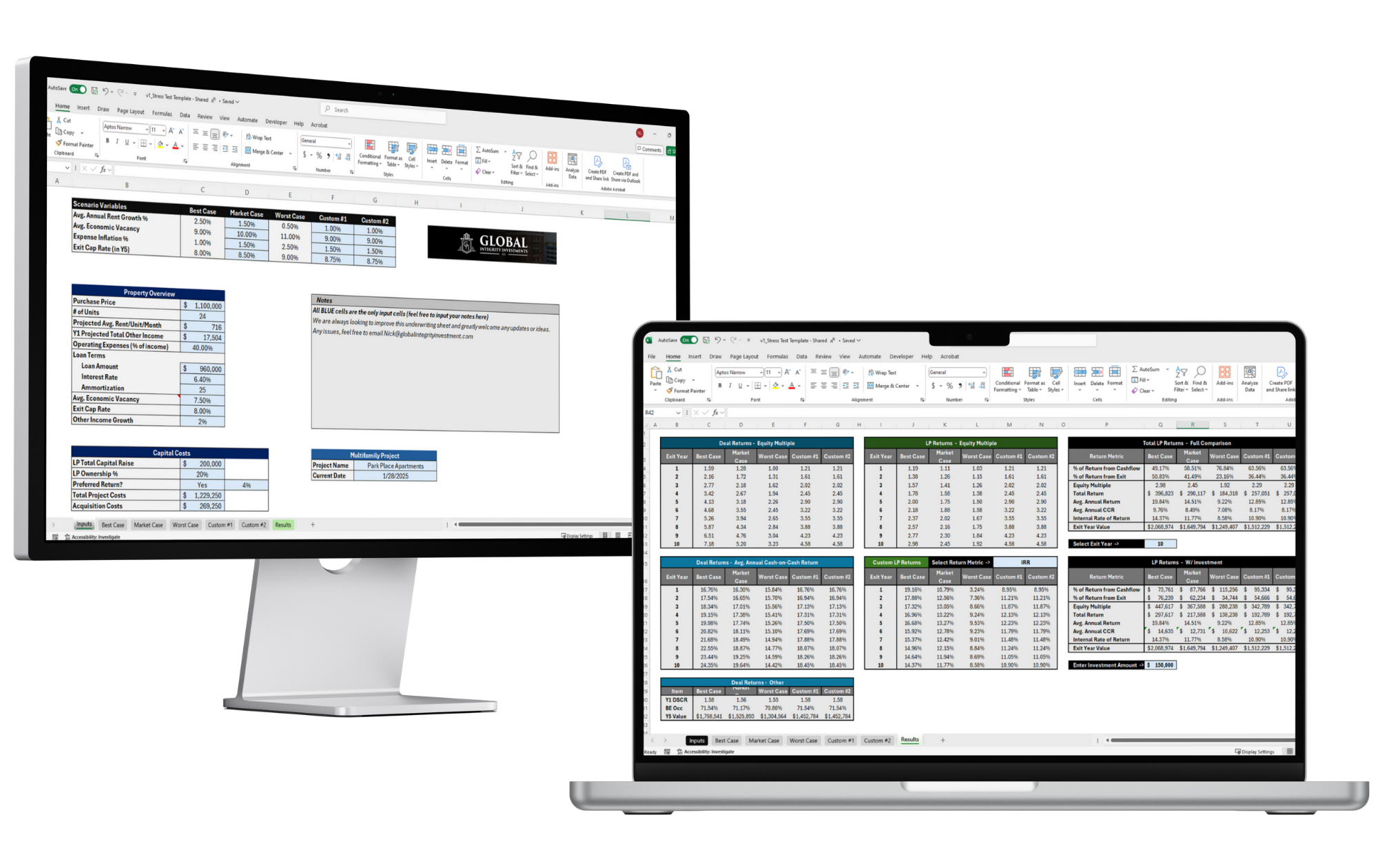

How Passive Investors Can Use It Today

- Calculate the Sharpe ratio for each deal you’re in to see how it compares to your portfolio average.

- Evaluate new investments using the Sharpe ratio rather than relying solely on IRR.

- Diversify across different risk levels to optimize your passive investment strategy.

Final Thoughts

If you’re not using the Sharpe ratio in your passive investing strategy, you’re missing a key piece of institutional-level risk management. The best investors don’t just chase returns—they maximize risk-adjusted performance to build sustainable wealth.