Introduction

As a seasoned passive investor with 2-5 deals under your belt, you’ve likely gained a solid understanding of multifamily syndications. You’ve mastered the fundamentals, navigated the onboarding process with sponsors, and reaped the benefits of cash flow and appreciation. But as your portfolio grows, new challenges emerge—liquidity management, sponsor vetting, tax optimization, and scaling efficiently.

At this stage, the goal isn’t just making more investments—it’s about making smarter investments. In this article, we’ll break down the key shifts required to scale from an intermediate to an advanced multifamily syndicator while optimizing returns and mitigating risks.

Understanding the Advanced Passive Investor Mindset

Transitioning from an intermediate investor (2-5 deals) to an advanced investor (5+ deals) requires a shift in approach. Instead of focusing solely on returns, advanced investors think holistically—balancing risk, tax efficiency, and long-term wealth-building strategies.

Key Shifts in Mindset: Intermediate vs. Advanced Investor

| Factor | Intermediate Investor (2-5 Deals) | Advanced Investor (5+ Deals) |

|---|---|---|

| Deal Sourcing | Relies on networking, crowdfunding, or referrals | Accesses off-market, exclusive institutional-grade deals |

| Sponsor Vetting | Looks at sponsor track record | Conducts deep due diligence, evaluates fee structures & GP alignment |

| Portfolio Strategy | Focused on returns & cash flow | Prioritizes risk-adjusted returns, tax efficiency, & liquidity |

| Diversification | Primarily multifamily syndications | Expands into mixed-use, build-to-rent, and institutional funds |

| Exit Strategy | Accepts sponsor’s business plan | Prefers flexible exit liquidity options (refi, secondary market sales) |

Building a Systematic Approach to Vetting Deals & Sponsors

One of the biggest shifts at this level is focusing less on the deal and more on the sponsor. Why? Because the right sponsor can make an average deal profitable, while the wrong sponsor can destroy even the best opportunity.

Red Flags in Sponsors to Watch Out For

- Overpromising Returns – If the projected IRR seems significantly higher than market averages, there may be unrealistic assumptions.

- Hidden or Excessive Fees – Look for sponsors who have no acquisition fees, no asset management fees, and offer a straight equity split with a preferred return.

- Limited Transparency – If sponsors hesitate to share underwriting models, financials, or business plans, it’s a sign to walk away.

- Poor Communication – Delayed responses, vague updates, or lack of detailed reports indicate potential management issues.

Key Vetting Questions for Sponsors

- How many deals have you exited successfully, and what were the actual vs. projected returns?

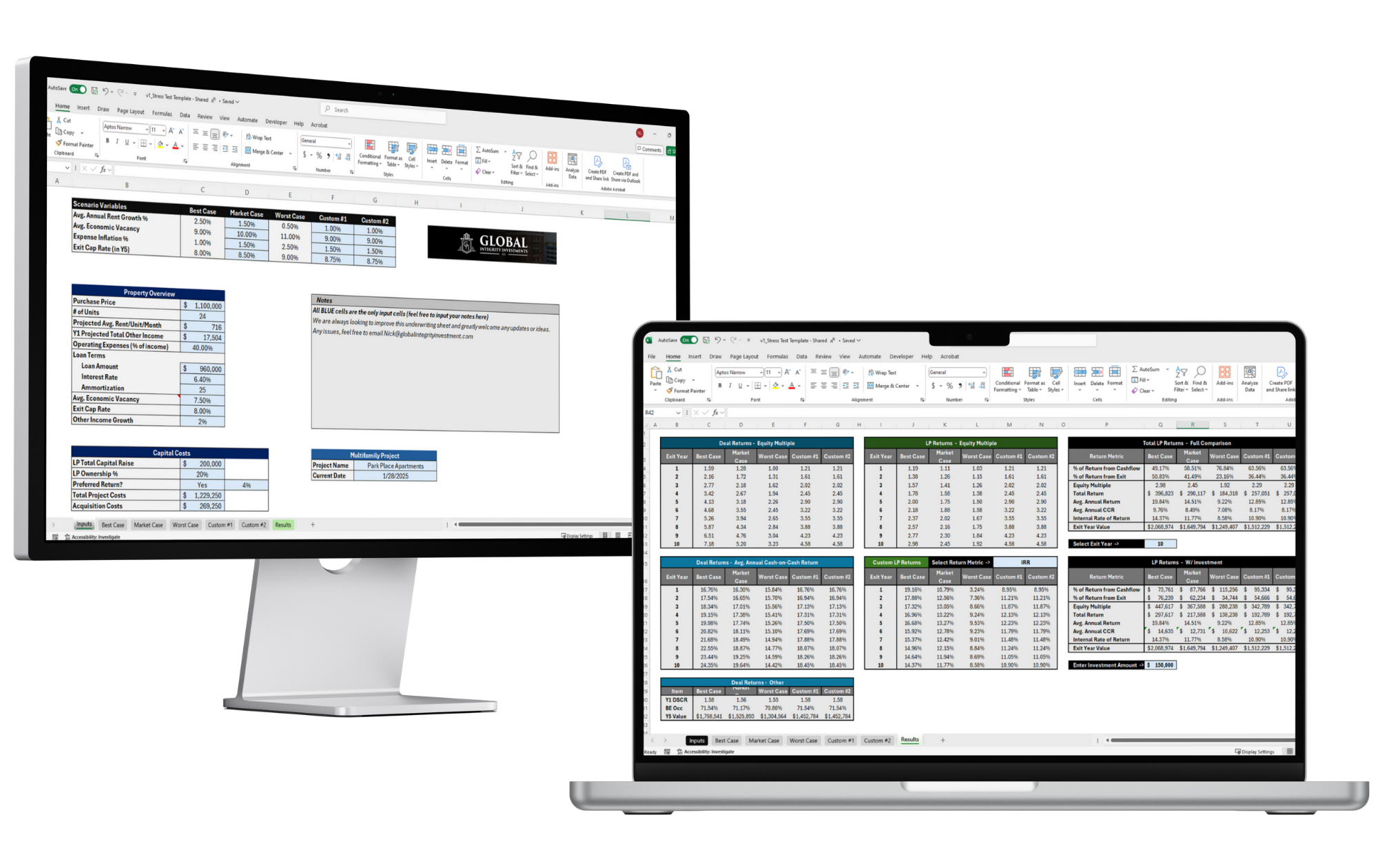

- What stress-testing models do you use to evaluate deals in a downturn scenario?

- How are your incentives aligned with investors?

- What happens if the project underperforms or hits unforeseen challenges?

- Are you personally investing in this deal, and how much skin do you have in the game?

By implementing a structured vetting process, you increase your chances of partnering with top-tier operators who deliver consistent, risk-adjusted returns.

How to Allocate Capital More Effectively Across Syndications

At the advanced level, the question isn’t just “Should I invest?” but rather “How should I distribute my capital across multiple investments?” Effective capital allocation balances risk, liquidity, and return optimization.

Strategies for Diversifying Syndication Investments

- Geographic Diversification – Instead of concentrating in one region, invest in multiple high-growth markets (e.g., Texas, Florida, and Arizona).

- Sponsor Diversification – Don’t rely on a single syndicator. Work with multiple proven sponsors to mitigate operator risk.

- Asset Type Diversification – While Class B/C value-add multifamily is a staple, consider alternative asset classes like build-to-rent, self-storage, and mixed-use developments.

- Liquidity Management – Allocate a portion of capital to syndications with refinancing potential, allowing you to recoup capital within 2 years while still benefiting from equity appreciation.

- Co-Investing in Deals – Instead of just being an LP, look for co-GP or preferred equity positions that provide better downside protection.

Capital Allocation Model for Advanced Investors

| Investment Type | % of Portfolio | Purpose |

|---|---|---|

| Traditional Multifamily Syndications | 50% | Core investment for cash flow & appreciation |

| Build-to-Rent & Self-Storage | 20% | Diversification into non-traditional real estate |

| Preferred Equity & Debt Funds | 15% | Lower-risk investments with predictable returns |

| Short-Term Lending (Private Notes, DSTs, REITs) | 10% | Provides liquidity in a typically illiquid portfolio |

| Opportunistic/Niche Strategies | 5% | High-risk/high-reward investments like new development or hotel conversions |

The Role of Tax Planning & Estate Structuring in Advanced Investing

As your portfolio grows, tax efficiency becomes just as important as returns. Many advanced investors miss out on tax strategies that could significantly boost their after-tax profits.

Advanced Tax Strategies for Passive Investors

- Cost Segregation & Bonus Depreciation – Accelerate depreciation to reduce taxable income significantly.

- 1031 Exchange Planning – Defer capital gains taxes by rolling proceeds into new properties.

- Opportunity Zones – Invest in qualified Opportunity Zone funds to receive capital gains tax deferrals and possible exemptions.

- Self-Directed IRAs (SDIRAs) & Solo 401(k)s – Shelter investments within tax-advantaged accounts.

- Estate Planning with Trusts – Utilize family offices, irrevocable trusts, and dynasty trusts for multi-generational wealth transfer.

Tax Strategy Example:

A high-net-worth investor used a cost segregation study on a multifamily investment, accelerating $500K in depreciation, reducing taxable income by $150K per year for three years, and freeing up cash for additional investments.

Tech & Tools to Manage Multiple Syndications Efficiently

With multiple syndications across various sponsors, tracking performance, distributions, and tax documents manually is inefficient. Advanced investors leverage technology to streamline portfolio management.

Best Tools for Passive Investors

- Stessa – Tracks cash flow, distributions, and investment performance across multiple syndications.

- Juniper Square – Institutional-grade platform for LP investors, providing detailed deal reports.

- Personal Capital – Integrates private real estate investments into broader net worth tracking.

- eMoney Advisor – Used by family offices to optimize estate planning and long-term wealth building.

By automating reporting and tracking, you gain better control over your investments without the administrative burden.

Conclusion

Scaling from an intermediate to an advanced passive investor requires a shift in mindset—from merely participating in syndications to strategically optimizing your capital, sponsors, and tax planning.

By systematically vetting deals, diversifying across syndications, utilizing tax strategies, and leveraging technology, you ensure higher returns, lower risk, and long-term financial growth.

Are you ready to scale your portfolio to the next level? Let’s discuss your investment strategy and how you can access exclusive, institution-grade deals today.