Over the past decade, institutional investors—hedge funds, private equity firms, and REITs—have been aggressively entering the workforce housing sector. What was once considered the domain of smaller, private investors is now attracting Wall Street-backed capital, changing the landscape of Class B and C multifamily investments.

For high-net-worth private investors, this shift presents both challenges and opportunities. On one hand, increased institutional interest means tighter competition and higher pricing. On the other hand, it validates workforce housing as a proven, recession-resistant asset class with strong risk-adjusted returns.

What is Workforce Housing—and Why Does It Matter?

Workforce housing refers to Class B and Class C multifamily properties that cater to middle-income earners, such as:

- Healthcare workers, teachers, and law enforcement professionals

- Skilled laborers, tradespeople, and service industry employees

- Renters earning between 60%-120% of Area Median Income (AMI)

Unlike luxury Class A apartments, workforce housing provides affordable, well-maintained living spaces for a critical segment of the workforce. With homeownership becoming increasingly out of reach due to rising interest rates, demand for rental housing has skyrocketed—particularly in the workforce segment.

According to a recent Harvard Joint Center for Housing Studies report, over 50% of U.S. renters now qualify as cost-burdened, meaning they spend more than 30% of their income on rent. This dynamic is precisely why institutional investors have taken notice.

Why Are Institutional Investors Flocking to Workforce Housing?

1. Recession-Resistant Demand

Class A luxury apartments may struggle during economic downturns, as renters downsize to more affordable housing options. Workforce housing, however, benefits from economic uncertainty—people who might have previously rented Class A properties trade down into Class B/C properties, keeping demand stable.

Private equity firms, hedge funds, and REITs are actively seeking out recession-resistant assets, and workforce housing is at the top of their list.

2. Supply and Affordability Gaps in Housing

The U.S. is experiencing a critical undersupply of affordable housing. In many major metros, developers have focused on building high-end luxury apartments because they offer higher per-unit profit margins. Meanwhile, very little new workforce housing is being developed.

Institutional investors recognize this supply-demand imbalance and see workforce housing as a way to deploy capital into an asset with consistent long-term demand.

3. Strong Rent Growth with Limited Downside Risk

Many workforce housing assets are undervalued compared to their replacement costs. Unlike Class A properties, which have hit affordability ceilings, workforce housing continues to see strong rent growth without massive tenant turnover.

For institutional investors looking to balance stable cash flow with appreciation potential, workforce housing provides an attractive risk-adjusted return.

4. Government Incentives and Tax Benefits

Federal, state, and local governments have introduced incentives for workforce housing investors, including:

- Low-Income Housing Tax Credits (LIHTC)

- Opportunity Zone tax benefits

- Public-private partnerships (P3s) offering tax abatements

Institutional capital has flooded into these programs, leveraging government-backed incentives to boost ROI.

How This Institutional Shift Affects Private Investors

While institutional investment validates the workforce housing sector, it also changes the playing field for private investors in three key ways:

1. Increased Competition for Class B/C Multifamily Assets

With deep pockets and access to low-cost capital, institutional buyers drive up property prices, making it harder for private investors to find attractive deals. Cap rates on Class B/C assets have compressed as large firms acquire properties at record levels.

💡 Private Investor Strategy:

- Focus on off-market deals through direct seller relationships

- Target secondary and tertiary markets where institutional capital is less concentrated

- Leverage value-add renovations to create upside potential beyond institutional-grade stabilized assets

2. Changing Debt and Equity Structures

As institutional firms dominate workforce housing, they influence financing trends. Banks and lenders now prefer working with institutional players, sometimes offering them better loan terms than private investors can access.

💡 Private Investor Strategy:

- Use creative financing like seller financing or private lending to remain competitive

- Partner with experienced sponsors who have strong lender relationships

3. Higher Quality Expectations from Tenants

Institutional investors bring professional-grade asset management to workforce housing, raising expectations for:

- Better property management services

- Higher-quality renovations and amenities

- More technology integration in leasing and maintenance

💡 Private Investor Strategy:

- Rebrand and reposition properties to match evolving tenant expectations (Example: Evergreen Estates)

- Use data-driven property management to maximize efficiency and resident satisfaction

How Private Investors Can Stay Ahead of Institutional Players

Despite the challenges, private investors still have key advantages over institutional firms:

✅ Flexibility – Private investors can move faster on deals without excessive corporate red tape

✅ Target Smaller Deals – Institutional investors avoid smaller properties (<100 units), creating opportunities for well-funded private investors

✅ Focus on Relationships – Private investors can build direct relationships with sellers, local lenders, and property managers—something institutional firms struggle with

Final Thoughts: Why Workforce Housing is a Must-Have in Your Portfolio

Institutional investors are betting big on workforce housing because it offers stable demand, strong rent growth, and recession-resistant cash flow. While private investors must adjust their strategies to remain competitive, workforce housing remains one of the best investment opportunities in today’s market.

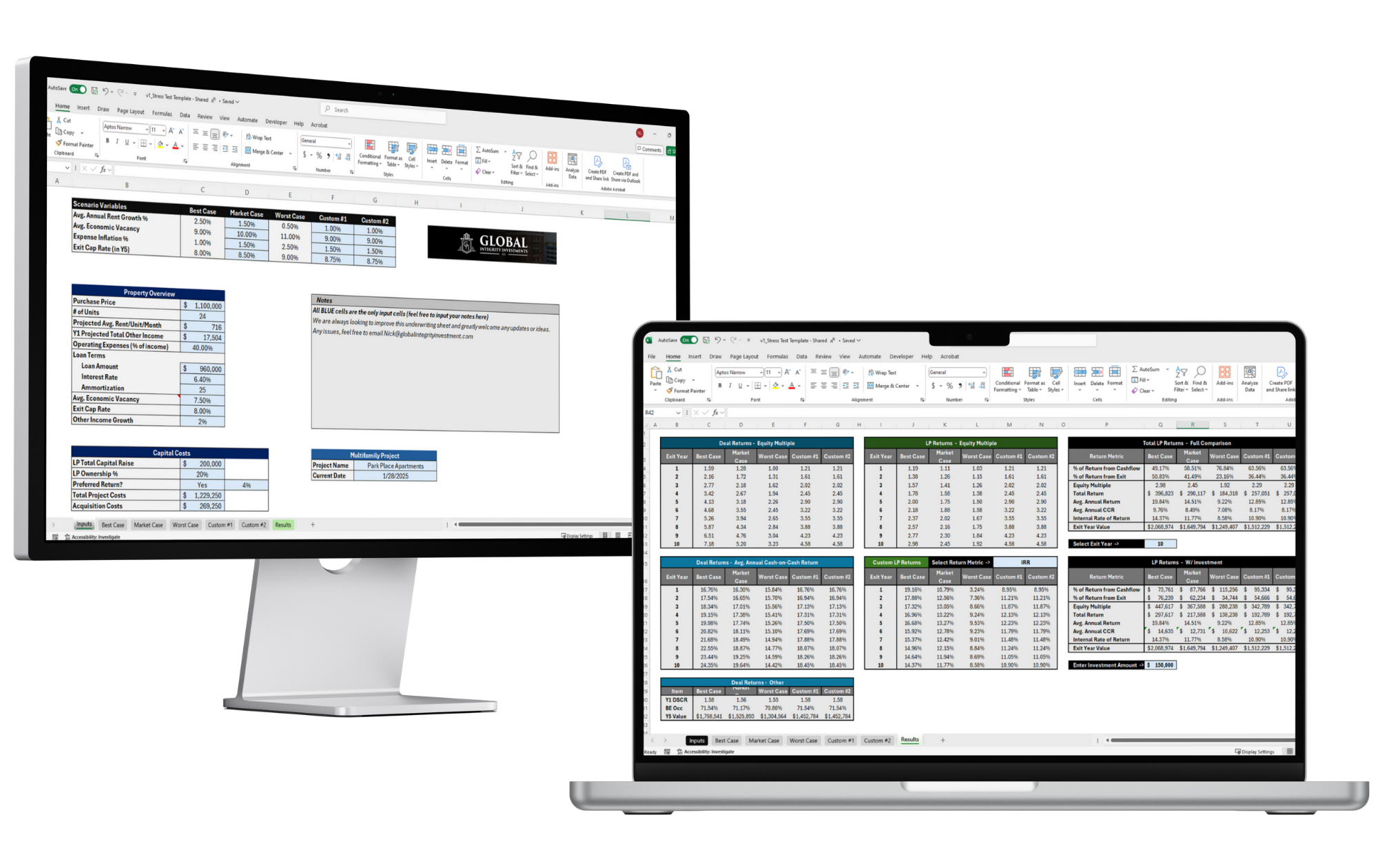

At Global Integrity Investments, we specialize in acquiring and repositioning workforce housing assets that provide high returns, reduced downside risk, and long-term appreciation. Our hands-on management, value-add strategies, and deep market expertise give us a competitive edge against institutional players.

If you’re an accredited investor looking to deploy capital into high-performing workforce housing assets, let’s connect.